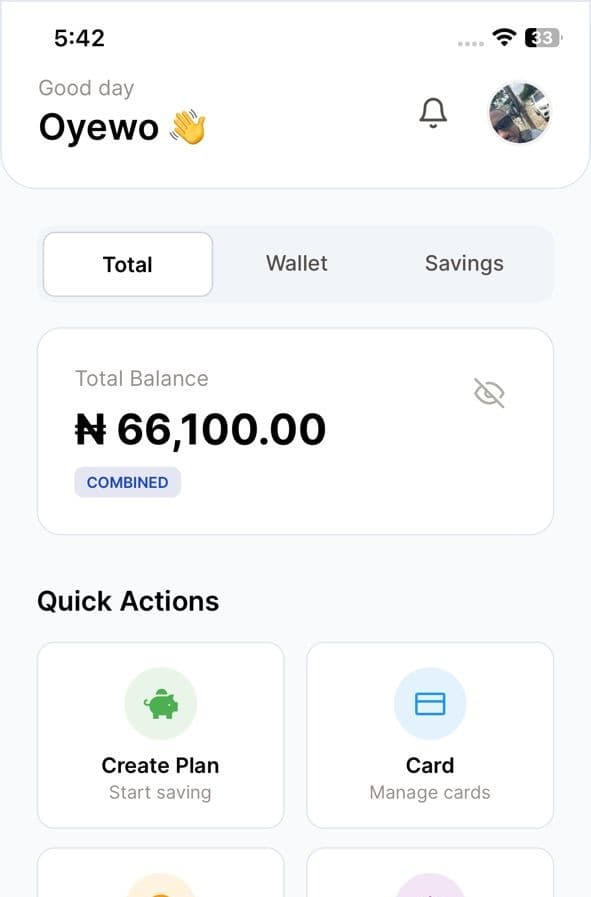

The Smart Way to Save and Invest

Savevest helps you save money, grow it automatically, and reach your goals faster. You can save alone or with friends, track your progress, and celebrate milestones together. Everything is simple, safe, and designed to make saving fun and easy.

The Future of Saving

Experience next-generation financial tools designed for the modern saver

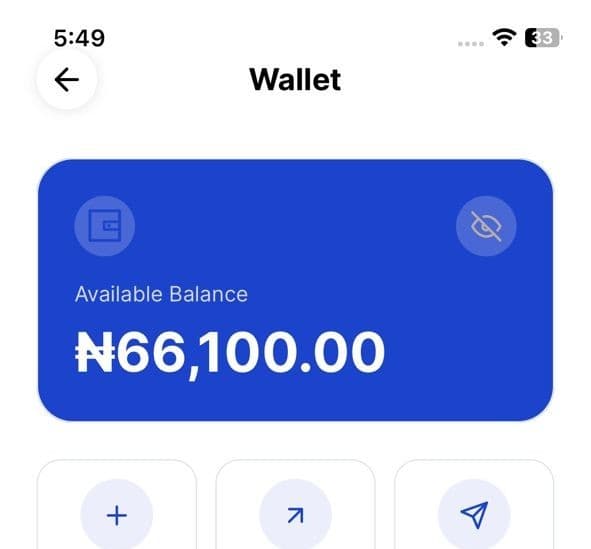

Save on the go

Don't fancy automatic savings? No problem, you can manually top up your Piggybank savings at anytime, anywhere.

Build discipline

With four free withdrawal days in the year, you are less tempted to spend your savings and meet your savings goals faster.

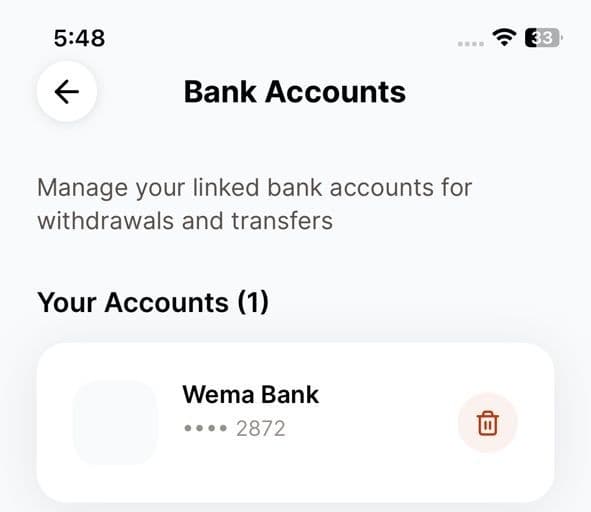

Quick withdrawal

Access your funds instantly when you need them. Fast and secure withdrawals with just a few taps.

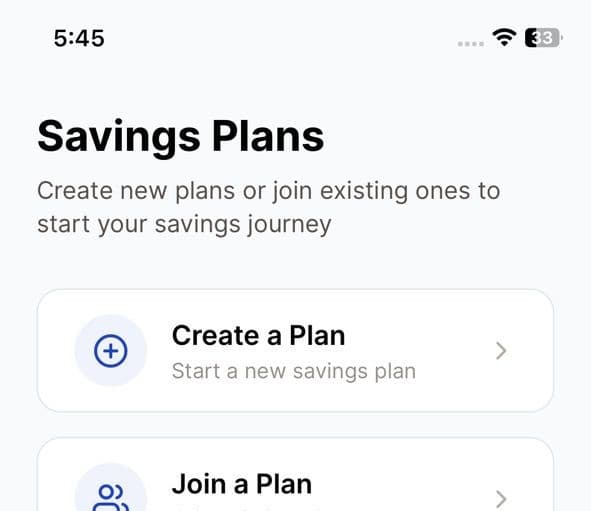

Saving is easier when you‘re not doing it alone.

With Savevest, you can team up with friends or family to reach shared goals, motivate each other, and celebrate every win together.

Questions?

We've got answers.

24/7 human support from our expert team. Real people, real solutions, real fast.

Contact Support